leonadman

Member

In the modern age of online shopping, digital transactions have become an essential part of our daily lives. However, the rise in online payment options also brings increased concerns over data security. If you are looking for a reliable tool to protect your personal and financial information, SafeCard might be the answer. In this SafeCard review, we will delve into the features, pros, cons, and overall effectiveness of SafeCard, helping you determine whether it's the right choice for securing your online payments.

What is SafeCard?

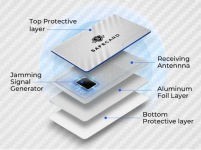

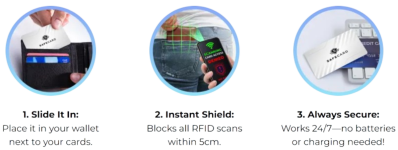

SafeCard is a digital payment card designed to protect your financial data while making online purchases. It acts as a temporary, one-time-use card, providing an added layer of security by shielding your actual credit card or bank account details. With increasing concerns about data breaches and fraud, SafeCard is an innovative solution to help keep your sensitive information safe.How SafeCard Works

SafeCard works by generating a virtual credit card number that is linked to your actual account. When making an online purchase, you can use this temporary number instead of your primary card details. The number is valid only for a specific period or for a specific transaction, reducing the risk of unauthorized access. Once the transaction is complete or the period expires, the virtual card number becomes useless.Key Features of SafeCard

- Temporary Card Numbers: SafeCard generates one-time-use virtual card numbers, ensuring your primary account details remain hidden.

- Security: Each generated card number is unique and encrypted, making it difficult for hackers to access or misuse your personal information.

- Multi-Purpose Usage: SafeCard can be used for a variety of online purchases, including subscriptions, one-time buys, and recurring transactions.

- Transaction Control: You can set limits on how much can be charged to the virtual card, giving you full control over your spending.

- Easy Integration: SafeCard works with all major e-commerce websites and integrates seamlessly with popular payment gateways.

Benefits of Using SafeCard

1. Enhanced Security

One of the biggest advantages of using SafeCard is the extra layer of security it provides. By masking your actual card details, it minimizes the risk of online fraud and identity theft. Even if a cybercriminal manages to intercept the virtual card number, they will not be able to use it for future transactions.2. Easy to Use

SafeCard is designed for ease of use. You don’t need to be tech-savvy to get started. The process of creating and using virtual cards is straightforward, and the integration with popular payment systems means you can use it at almost any online store.3. Peace of Mind

With SafeCard, you can make online transactions with confidence, knowing your financial information is protected. The temporary nature of the virtual card number adds peace of mind, especially when shopping at new or unfamiliar websites.4. Prevention of Unauthorized Transactions

SafeCard gives you the option to set spending limits and expiration dates on virtual cards, preventing unauthorized transactions from going through if your details are somehow compromised.

SafeCard: Pros and Cons

Pros:

- Highly Secure: SafeCard provides top-notch security features, ensuring your personal information is kept safe.

- Convenient: With easy setup and integration, SafeCard simplifies the process of making secure online transactions.

- Cost-Effective: Most SafeCard services are available at a low cost or even for free, making it an affordable solution for anyone looking to enhance their online payment security.

Cons:

- Limited Availability: While SafeCard works with most online retailers, it might not be accepted at every website, particularly those that don’t support virtual credit card services.

- Potential Fees: Some SafeCard services charge fees for generating virtual cards, which may add up over time.

How SafeCard Compares to Other Payment Methods

When compared to traditional credit cards or digital wallets like PayPal, SafeCard offers superior protection for online transactions. Unlike credit cards, where your actual card number is exposed, SafeCard minimizes the risk by generating unique, temporary numbers for each purchase. This makes it an ideal solution for those who want to ensure maximum security when shopping online.SafeCard Reviews: What Users Are Saying

User reviews for SafeCard are largely positive, with many praising its ease of use and enhanced security features. Customers appreciate how quickly they can generate a virtual card and use it for online transactions without worrying about their financial details being compromised. However, some users have mentioned occasional compatibility issues with specific merchants, though these instances are relatively rare.

Is SafeCard Worth It?

If you're serious about online security, SafeCard is a valuable tool that can provide significant peace of mind. Its ability to generate one-time-use virtual card numbers makes it an excellent option for reducing the risk of fraud. Additionally, its ease of use and affordability make it accessible to everyone, from casual online shoppers to frequent e-commerce customers.However, it’s important to consider whether SafeCard is compatible with your preferred online stores and whether the fees (if applicable) fit within your budget. Overall, SafeCard is a reliable, secure choice for anyone looking to protect their financial information while shopping online.

Conclusion On SafeCard Reviews

In conclusion, SafeCard is a highly effective solution for securing online transactions. With its temporary virtual card numbers, advanced encryption, and user-friendly features, it offers an added layer of protection against fraud and identity theft. While it may not be accepted everywhere, it remains a top choice for users looking to enhance their digital payment security.If you're concerned about the safety of your online transactions, SafeCard is worth considering. By adding an extra barrier between you and potential fraudsters, it allows you to shop online with confidence.

---------------------------------------------------------------------------------------------------------------------------------------------------------------

Last edited: